Technical Bulletin:

Early access to superannuation

On 22 March 2020 the Government announced some significant relief measures that will most definitely impact some SMSF members and may avail other members to opportunities to access benefits directly from their superannuation fund subject to meeting certain criteria. Here is a brief summary of the key announcements directly linked to superannuation:

Providing support to retirees

Full details (to date) can be found at https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Providing_support_for_retirees_to_manage_market_volatility.pdf

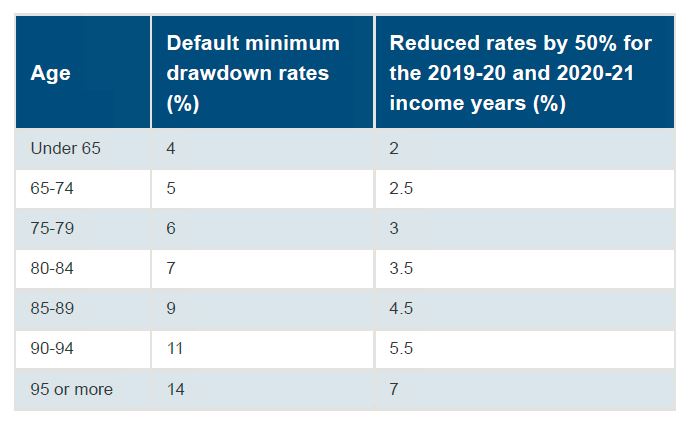

50% reduction in minimum pension drawdowns

Effective immediately, the minimum pension requirements for the 2019/20 Financial Year have been reduced by 50%. The announcement also extends the relief to the 2020/21 Financial Year.

Whilst not made absolutely clear via the release, it suggests that the same relief will apply to all similar products, meaning it is likely that Market Linked (Term Allocated) Pensions will also have 50% relief.

The relief does not reduce the maximum allowable under a transition to retirement income stream, it is merely a means to assist in the preservation of capital.

WARNING: This announcement does not make any suggestion that if you have taken more than the 50% reduced minimum you can reimburse the fund, any such amount would be considered a contribution and be subject to the existing contribution rules. If you don’t know the rules please contact us.

Reduction in Social Security deeming rates

From 1 May 2020 the upper deeming rate for Social Security purposes will be 2.25% and the lower rate will be 0.25%. This announcement does not necessarily require any action, however, it may result in changes to Age Pension limits for some clients. Please contact your local Services Australia branch to access more information, or subsequently visit https://www.servicesaustralia.gov.au/ for more information.

Early access to superannuation

Full details (to date) can be found at https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Early_Access_to_Super_1.pdf

WARNING: This is not applicable to all superannuation members AND is subject to ATO approval.

Those who have been significantly financially affected by Coronavirus will be eligible to apply for up to $10,000 from their superannuation during 2019/20 and up to a further $10,000 in the first few months of 2020/21. ALL applications must go through the MyGov website www.my.gov.au

To be eligible to apply you must satisfy one or more of the following criteria:

• You must be unemployed; or

• You must be eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

• on or after 1 January 2020:

○ you were made redundant; or

○ your working hours were reduced by 20% or more; or

○ if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20% or more.

The ATO will provide further details about how this measure will apply to SMSFs. Once this information is available it will be provided to our Client Managers.

WARNING: This is not a self-assessment and, based on the information provided, a fund can only act on receipt of a determination from the ATO.

We will continue to keep you up to date on the latest announcements as they occur.

To download the PDF version click here.