The proposed $3 million superannuation tax introduced by the Australian Government aims to adjust the tax concessions for individuals with superannuation balances exceeding $3 million. Set to begin from 1 July 2025, this policy intends to apply a 30% tax rate on the earnings from the portion of superannuation balances above this threshold. Currently, earnings on superannuation in the accumulation phase are taxed at a concessional rate of 15%.

On the surface this may seem simple, but in this paper we will look deeper, to understand how it is intended to work and some of the things you will need to consider, if you are likely to be impacted by the introduction of this new tax.

While there are many different views on the how this tax should or should not be applied, this paper is not intended to cover those views, but will consider the proposed tax in its current form, based on the following Bills, which were introduced to Parliament on 30 November 2023:

– Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023.

– Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023.

Let’s consider some of the questions you might have about this new tax.

How is the tax calculated?

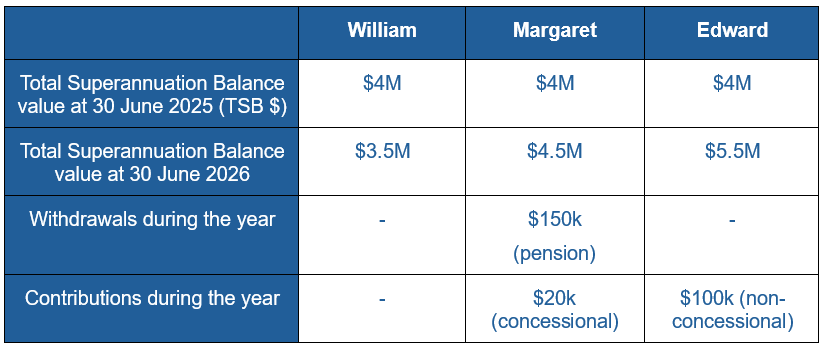

PART 1: Start by calculating the Total Superannuation Balance Proportion (TSB %) above the $3 million Large Superannuation Balance (LSB) threshold.

– ((TSB at the end of the year – LSB threshold) / TSB at the end of the year) x 100.

Note, this formula is rounded to 2 decimal places.

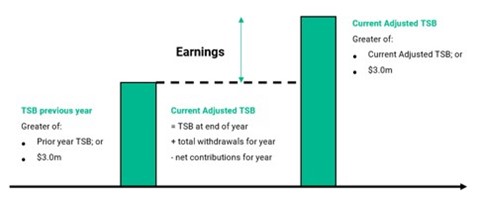

PART 2: Next, calculate the Adjusted Total Superannuation Balance at the end of the year (Adjusted TSB).

– TSB at the end of the year + total withdrawals during the year – net contributions during the year.

Note, net contributions means 85% of concessional contributions.

PART 3: Now, using the Adjusted TSB calculated in part 2, calculate the value of the Taxable Superannuation Earnings (TSE $).

– (The greater of Adjusted TSB at the end of the year or $3 million) – (the greater of TSB at the end of the previous year or $3 million).

PART 4: Finally, combine parts 1 and 2 by applying the proportion (TSB %) to the amount of Taxable Superannuation Earnings (TSE $) and apply the applicable division 296 tax rate of 15%

– TSB % x TSE $ x 15%

Let’s consider how this applies in 3 different examples:

What if my balance is under $3 million at 1 July 2025?

You will note that the first part of the calculation above only refers to the balance at the end of the year, so it is the balance at the end of the year that is most important. This means that as long as your balance is still under $3 million at 30 June 2026, then the tax will not apply to you. However, if your balance at 30 June 2026 exceeds $3 million, the Division 296 tax will apply, even if your balance was less than $3 million at the start of the year.

Are there any other exemptions?

Yes, it is important to note that an individual who meets any of the following exemptions in an income year will not be liable for the tax.

– Child recipients of a superannuation income stream.

– Individuals who have ever received a structured settlement contribution.

– Individuals who have died before 30 June of the relevant year.

What if I don’t sell any investments during the year?

You will note that the Taxable Superannuation Earnings are calculated with reference to the value of the super balance at the end of the year, not the actual income or realised gains (from investments that are sold during the year). This means that even if you still own the investment at the end of the year, the increase in the value of the investment will be included when calculating the Division 296 tax.

This is one of the things that makes this tax unique, in that it taxes the increase in value of your super investments, not just the income that those investments generate. Under other circumstances, it is not until an investment is sold that tax is levied on the gain in value of the investment.

Do I need to do something about this now?

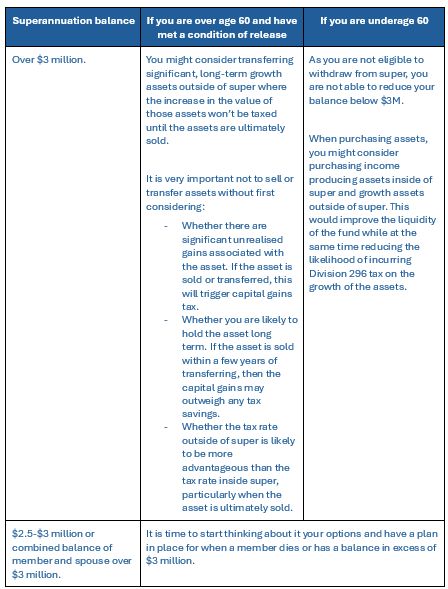

Many will never have $3 million in their super fund and so will not need to contemplate this tax at all. Naturally though, if you already have $3 million in your super fund, or if there is a chance that you may have at some stage, you might be thinking about whether you should contribute less or withdraw more from your super, if you are eligible, in light of these new rules.

Speaking with a qualified financial advisor would be an excellent first step. They can consider your personal situation and help you to understand whether there are any strategies that you might employ and the impact of those strategies for you now and in the future.

Below are some points to consider with your financial advisor.

Can anything be done to minimise the impact of this tax?

There is certainly no one-size-fits-all approach when it comes to strategies for reducing or deferring the tax liability.

Of course, for those who are eligible to withdraw from their super fund, there is the possibility of reducing the Division 296 tax liability to NIL by withdrawing all but $3 million from the fund, before the end of the relevant year.

This will certainly help in saving Division 296 tax, but those savings may not always out-weigh the costs.

Reducing the types of investments that create unrealised gains in the super fund would also assist in taking the sting out of this tax.

At the very least, the fund’s investment strategy should be reviewed with respect to asset allocation and liquidity. With the way that this tax is applied, there will be a greater incentive to maintain liquidity and reduce the proportion of the fund that is invested in illiquid, long term growth orientated assets.

Before making any decisions, you should discuss your objectives with a qualified financial advisor. They can consider your personal situation and help you to understand whether there are any strategies that you might employ and the impact of those strategies for you now and in the future.

What happens if I take money out of super?

There are many more factors to consider if investments are being sold or transferred out of the fund, including:

– Is the investment growth or income producing?

– Is the investment typically traded or held for less than 12 months?

– Is the investment likely to be sold in the near future?

– Is the effective tax rate outside of super less and will that rate still be less when the investment is ultimately sold?

– Is there an unrealised gain associated with the investment, which will trigger capital gains tax when the investment is sold or transferred from the super fund?

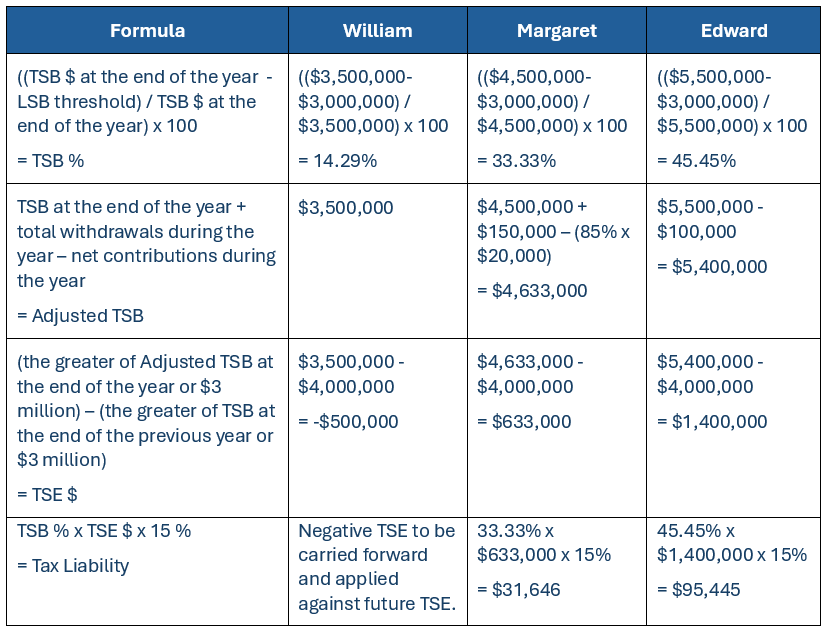

Let’s consider 2 scenarios:

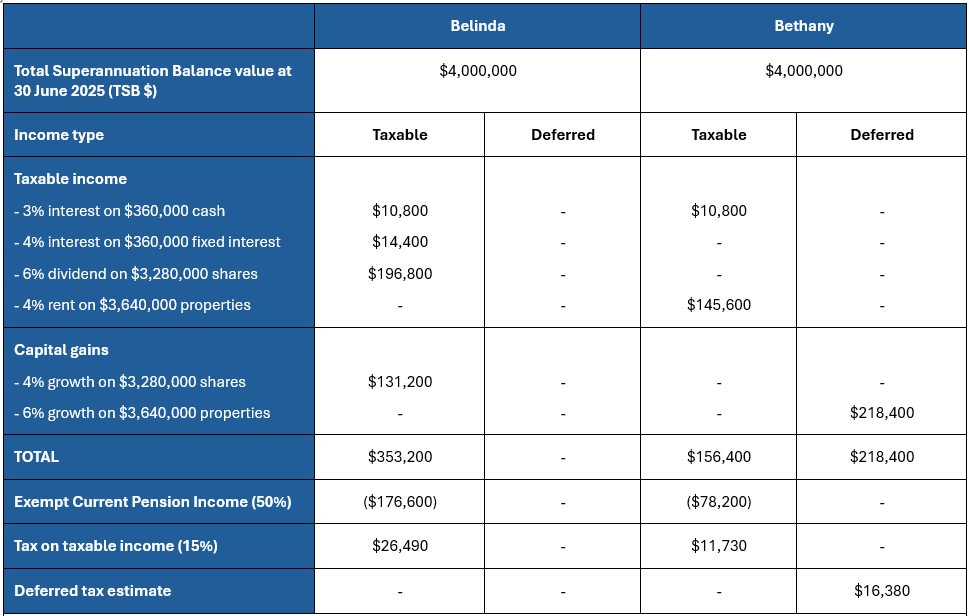

– At 30 June 2025 Belinda has $360k cash, a $360k fixed interest deposit and a $3.28 million portfolio of Australian shares in her super fund, which she typically holds for less than 12 months.

– At 30 June 2025 Bethany has $360k cash, a property valued at $2.49 million (purchased 5 years ago for $2 million) and another property valued at $1.15 million (purchased 2 years ago for $1 million) in her super fund. She plans to hold both properties for a further 5 years.

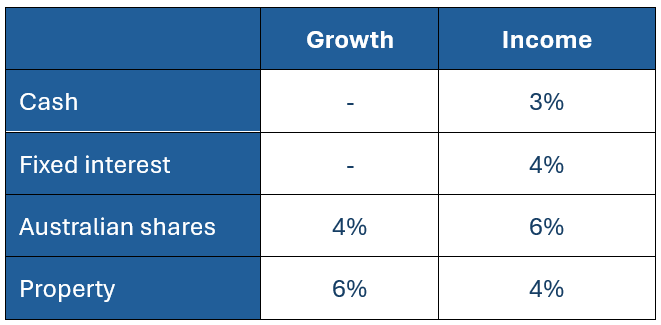

– Returns are as follows:

– Both have $2 million in retirement phase account based pensions as at 30 June 2025 and withdraw $150k pension per annum.

– Both funds have an actuarial percentage of 50%

– Both have other personal taxable income of $45k

Scenario 1: Neither withdraw any money from super

Belinda is generating more income in her super fund than Bethany and she is turning over her investment portfolio on at least an annual basis, compared with Bethany who has a buy and hold strategy for her properties. This means that a greater portion of Belinda’s returns will be taxed under the traditional income tax rules.

Bethany on the other hand won’t pay as much traditional income tax from year to year, as the tax on capital gains is not realised until a property is sold. However, growth in the value of her properties will still be included in the calculation of her Division 296 tax, despite not having sold either of her properties during the year.

Scenario 2: Both transfer investments from their super

funds into their personal names to bring their Total Superannuation Balance

values below $3 million by 30 June 2026.

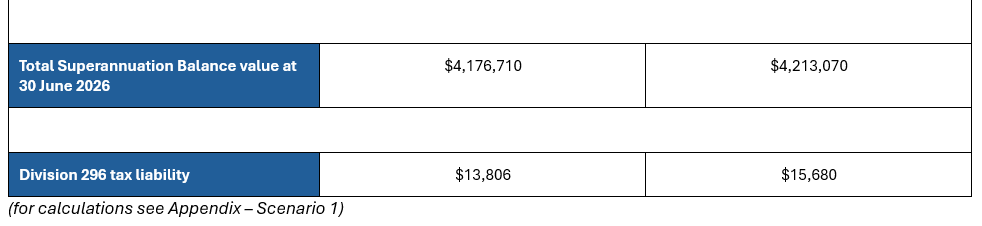

– Belinda’s estimated Total Superannuation Balance

value at 30 June 2026 is $4,176,710 so she transfers $1 million in shares and a

further $186,710 in cash into her personal name at 30 June 2026.

o

Belinda’s Total Superannuation Balance value at

30 June 2026 is now $2,990,000. Given this is less than $3 million, Belinda

will no longer be liable for Division 296 tax for the 2025/26 year. This

saves Belinda $13,806 in Division 296 tax.

(for calculations see Appendix – Scenario 2)

o

There may be costs associated with the transfer

of the shares, such as transfer fees and Capital Gains Tax (CGT). However, as Belinda

typically holds shares for less than 12 months and the gains have been

accounted for in the tax paid by the super fund during the year, we have not considered

these costs to be material for Belinda.

o

As the cash and shares are now held in Belinda’s

personal name, the super fund will no longer need to pay tax on the associated

income and capital gains. This will save Belinda $7,920 in tax in the

following year.

(for calculations see Appendix – Scenario 2)

o

The income and capital gains on the investments

that have been transferred will be taxable to Belinda personally going forward.

This will cost Belinda $32,772 in additional tax in the following year.

(for calculations see Appendix – Personal Tax)

Based on this example, the additional tax Belinda

will pay personally, far outweighs the income tax and Division 296 tax that

would have been incurred if the assets had been left in the super fund.

– Bethany’s estimated Total Superannuation Balance value at 30 June 2026 is $4,213,070 so she transfers the property previously valued at $1.15 million into her personal name at 30 June 2026. The property is now

valued at $1.219 million.

o Bethany’s Total Superannuation Balance value at 30 June 2026 is now $2,983,120. Given this is less than $3 million, Bethany will no longer be liable for Division 296 tax for the 2025/26 year. This saves Bethany $15,680 in Division 296 tax. (For calculations see Appendix – Scenario 2)

o As the transfer of the property is a Capital Gains Tax (CGT) event, Bethany’s super fund must pay CGT on the transfer of the property. This costs Bethany $10,950 in CGT. (For calculations see Appendix – Property CGT)

o There may be other costs associated with the transfer, such as conveyancing fees, transfer fees and stamp duty. As these costs can vary from state to state, we have not specified these costs.

o As the property is now held in Bethany’s personal name, the super fund will no longer need to pay tax on the associated income. This will save Bethany $3,733 in tax in the following year. (For calculations see Appendix – Scenario 2)

o The income from the property that has been transferred will be taxable to Bethany personally going forward. This will cost Bethany $14,628 in additional tax in the following year. (For calculations see Appendix – Personal Tax).

Based on this example, Bethany will pay an additional $14,628 in personal income tax, but save $3,733 in income tax and

$15,680 in Division 296 tax in her super fund; a benefit of $4,785. It will take Bethany 2 years and 3 months for these savings to cover the initial CGT cost alone, without considering other costs associated with the transfer.

Notwithstanding this benefit, if Bethany were to sell this property after a further 12 months, she should expect to pay

between 15% and 22.5% CGT on any gain in the value of the property. By comparison, once you consider the tax exempt portion of her super fund and the relevant CGT discount, the effective rate of CGT paid in her super fund is 5%.

(50% actuarial % x (1-1/3) CGT discount x 15% super tax rate)

As the $3 million threshold is not indexed, this strategy will only eliminate the Division 296 tax in the first year. Where this strategy is considered to be effective, a similar strategy would also need to be considered in subsequent years in order to remain below the $3 million threshold.

What if I have other plans for the money outside of super?

To this point we have considered investing inside of super vs investing outside of super.

This new tax will provide less incentive to retain money in the super environment and it is likely that some may choose to put more of their wealth towards other causes such as improving or upgrading their main residence, supporting family members financially or establishing a Private Ancillary Fund (PAF) for charitable purposes.

Your personal objective should always be considered first, and if you have plans that involve spending or gifting this money, then they should be considered and discussed with your financial advisor.

In summary

The way that this new tax is calculated is quite unique and the impact on individuals needs to be considered carefully, on a case-by-case basis. In many cases, superannuation will continue to be an attractive and cost effective vehicle for wealth accumulation and estate planning, even for balances in excess of $3 million.

For some who are impacted by this new tax and have the ability to withdraw from super, it appears that:

– If investment returns are mostly income (not growth), it is generally slightly better to keep the investment in super, even

with Division 296 tax.

– If investment returns are mostly growth (not income) and there is a regular turnover of assets (at least annually), it is

generally better to keep the investment in super, even with Division 296 tax.

– If investment returns are mostly growth (not income) as part of a buy and hold strategy, there will often be tax savings in

the short term if the investment is held outside of super, but additional tax to pay at the time of sale.

Before making any decisions, you should discuss your objectives with a qualified financial advisor. They can consider your personal situation and help you to understand whether there are any strategies that you might employ and the impact of those strategies for you now and in the future.

We would be pleased to provide your financial advisor with up-to-date information and technical support to assist.