The standard concessional contribution cap, the limit for concessionally taxed employer and personal deductible contributions. It is subject to indexation, based on …

SuperGuardian is an independently owned Chartered Accounting firm and specialist self-managed

super fund (SMSF) Administrator with more than 20 years experience.

SuperGuardian ensures Trustees and Financial Advisers have ready access to the facts, tools and support they need to make informed decisions and to maximise wealth creation.

Are you looking for a transparent and feasible solution for your own super?

Would you like to add value to your clients with a daily online reporting solution?

Would you like someone, in your world, to support and compliment your advice?

SuperGuardian Difference

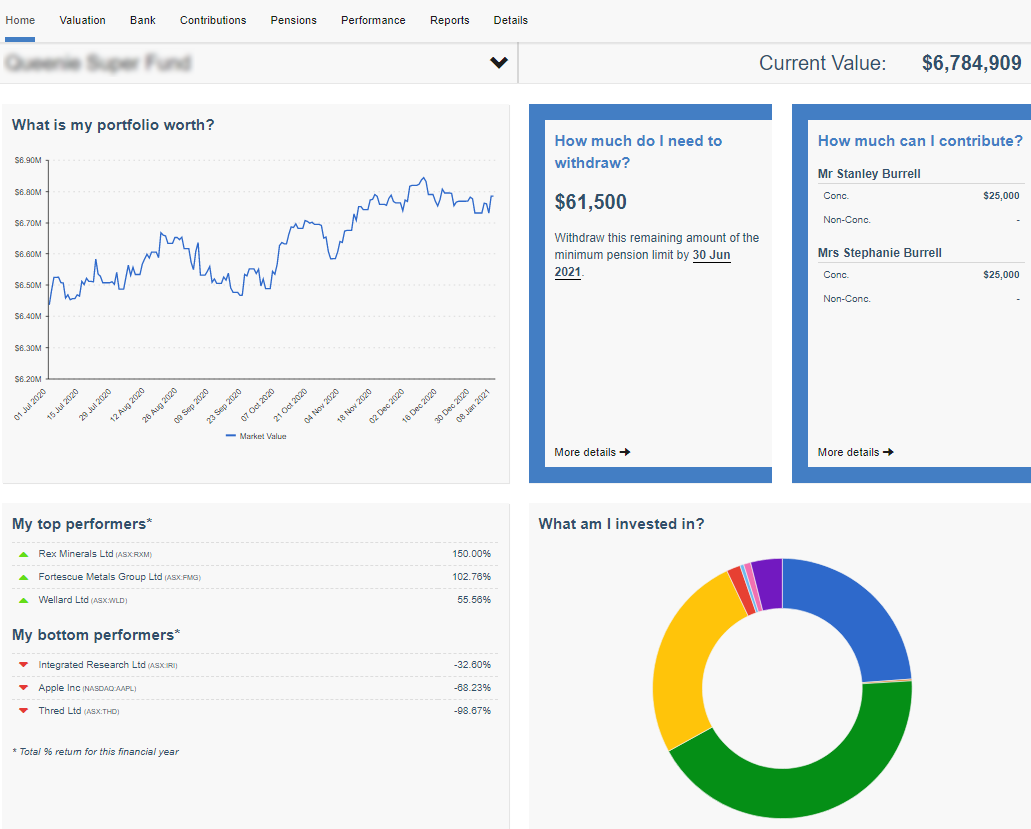

Premium Online Dashboard

We offer 24/7 online access to premium reports, updated daily.

Qualified and Dedicated Client Managers

Our passionate Client Managers are available for unlimited support and guidance.

High Quality of Service

You can trust in the quality of our service. Don’t take our word for it – check out our testimonials.

Fixed Service Fees

We offer competitive, transparent, fixed service fees so you know your fees in advance. No hidden charges and no surprise bills at the end of the financial year.

Do more with SuperGuardian

Latest from SuperGuardian

The standard concessional contribution cap, the limit for concessionally taxed employer and personal deductible contributions. It is subject to indexation, based on …

Borrowing within a Self-Managed Superannuation Fund (SMSF) can be a useful strategy forinvesting retirement savings, allowing an SMSF to acquire significant assets …

AFSL 485643

Copyright © 2019 – 2021 SuperGuardian Pty Ltd ABN 57 113 986 968

Liability limited by a scheme approved under Professional Standards Legislation