The SMSF Annual Return is an important document that covers the income tax return, regulatory information and member contribution reporting; and also …

SuperGuardian is an independently owned Chartered Accounting firm and specialist self-managed

super fund (SMSF) Administrator with more than 20 years experience.

SuperGuardian ensures Trustees and Financial Advisers have ready access to the facts, tools and support they need to make informed decisions and to maximise wealth creation.

Are you looking for a transparent and feasible solution for your own super?

Would you like to add value to your clients with a daily online reporting solution?

Would you like someone, in your world, to support and compliment your advice?

SuperGuardian Difference

Being one of the largest SMSF Administrators, SuperGuardian provides

a full service solution but our key point of difference is our client-centric approach.

For further information on the SuperGuardian service, please view our Client Service Guide.

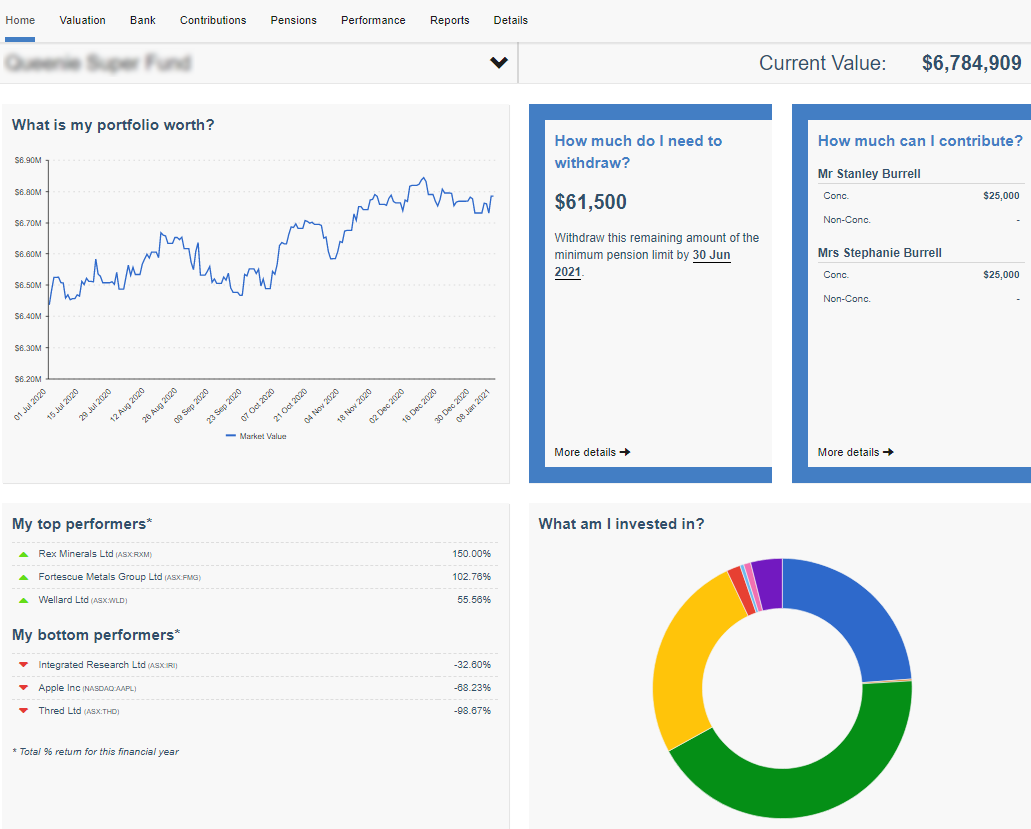

Premium Online Dashboard

We offer 24/7 online access to premium reports, updated daily.

Qualified and Dedicated Client Managers

Our passionate Client Managers are available for unlimited support and guidance.

High Quality of Service

You can trust in the quality of our service. Don’t take our word for it – check out our testimonials.

Fixed Service Fees

We offer competitive, transparent, fixed service fees so you know your fees in advance. No hidden charges and no surprise bills at the end of the financial year.

Do more with SuperGuardian

Latest from SuperGuardian

The SMSF Annual Return is an important document that covers the income tax return, regulatory information and member contribution reporting; and also …

Housing affordability has long been an issue in Australia. As part of the 2017 Budget, the government introduced a measure aimed at …